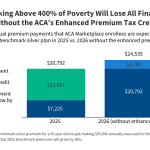

Premium Payments if Enhanced Premium Tax Credits Expire

This data note examines how the expiration of the ACA’s enhanced premium tax credits could affect the out-of-pocket portion of premiums for different households.

State Pension Age review: what advisers need to know

The Government has launched its third review of the State Pension age. Discover the implications for advisers and paraplanners, and client planning.

Designing a benefits strategy that prioritises employee wellbeing

Employee expectations are changing fast – and benefits strategies need to keep up. Here’s why a one-size-fits-all approach is no longer enough.

Moody’s says a $100bn single cat could be an earnings event: Siddiqui & Eck

In an interview with Reinsurance News during the 2025 RVS in Monte Carlo, Salman Siddiqui, Associate Managing Director at Moody’s Ratings, and James Eck, Vice President–Senior Credit Officer at Moody’s Investors Service, explained that while a single $100 billion catastrophe…

Walter Voigts-von Forster named CEO of Munich Re Africa Branch

Global reinsurer Munich Re has announced the appointment of Walter Voigts-von Forster as Chief Executive Officer (CEO) of Munich Re Africa Branch, effective 1st February 2026. Voigts-von Forster will continue as Head of Non-Life for Munich Re Africa while assuming…

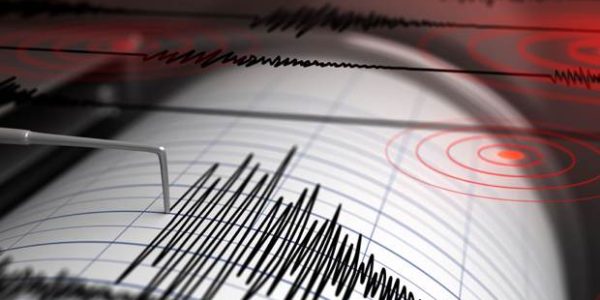

Miller announces parametric earthquake solution in partnership with SPG Canada & NormanMax

Independent specialist re/insurance broker, Miller has partnered with Specialty Program Group Canada (SPG Canada) and NormanMax Syndicate 3939, to launch a new parametric earthquake solution which aims to address the growing concerns about the accessibility of earthquake insurance in the…

London Market premium income climbs 1.7% to £49.3bn in 2024: IUA

According to new data published by the International Underwriting Association (IUA), London Market companies earned a total premium income of £49.273 billion in 2024, up 1.7% compared to 2023. According to the IUA’s latest London Company Market Statistics Report, compiled…

Zitzmann to lead Skyward Specialty’s Inland Marine and Transactional Property

Skyward Specialty Insurance Group has hired Christopher Zitzmann as President of Inland Marine and Transactional Property. In the new role, Zitzmann will reportedly lead growth and innovation across Skyward Specialty’s inland marine and transactional property businesses, advancing the firm’s expertise…

Further consolidation likely as climate risks and technology transform the market: Urs Baertschi, Swiss Re

Urs Baertschi, Chief Executive Officer of Property & Casualty Reinsurance at Swiss Re, emphasised that discipline and stability remain key for the reinsurance industry, with further consolidation likely as climate risks and technological shifts reshape the market. In our latest…

Glyn Hughes joins Allianz Personal Broker as MD

Allianz UK has announced the appointment of Glyn Hughes as Managing Director of Allianz Personal Broker, effective February 2026. Subject to regulatory approval, Hughes will join the UK personal lines leadership team reporting to Serge Raffard, Managing Director of Allianz’s…