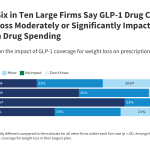

Perspectives from Employers on the Costs and Issues Associated with Covering GLP-1 Agonists for Weight Loss

While more large employers are covering GLP-1 drugs for weight loss, KFF’s conversations with employers highlight concerns about the cost of these medications. Many of these employers have considered scaling back coverage of GLP-1 agonists for weight loss, or in…

The Semi-Sad Prospects for Controlling Employer Health Care Costs

In a commentary on KFF’s 27th employer health benefits survey, President and CEO Dr. Drew Altman discusses the obstacles employers face trying to control their health care costs, and the reasons why they’ve never been meaningful supporters of government cost-containment…

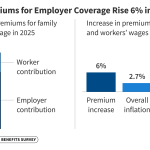

2025 Employer Health Benefits Survey

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, worker contributions, cost-sharing provisions, offer rates, and more. This year’s report also looks at how employers are approaching coverage of GLP-1 drugs for…

Explaining Individual Coverage Health Reimbursement Arrangements (ICHRAs)

This policy explainer describes what Individual Coverage Health Reimbursement Arrangements (ICHRAs) are and how do they differ from typical employer-sponsored health care plans.

Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2025

Since 1999, the Employer Health Benefits Survey has documented trends in employer-sponsored health insurance. Every year, private and non-federal public employers with three or more employees complete the survey.

Previsico closes Series A funding round to accelerate global growth

Previsico, the actionable flood warning insurtech, has announced the successful close of its Series A funding round to accelerate its global expansion. The round included investment from Connecticut Innovations (CI), Connecticut’s strategic venture capital arm, and BlueOrchard Finance Limited, a…

Clear evidence re/insurance industry is still cyclical: W. R. Berkley CEO

Re/insurance market dynamics through the third quarter shows that the industry is still cyclical, and while there’s still margin in the property catastrophe reinsurance business, it is eroding and is no longer as attractive as it was in recent times,…

85% of insurers negatively impacted by third-party risks: Dun & Bradstreet

Insurance companies are facing growing third-party risk, with 85% of UK insurers and brokers having experienced negative impacts from such risks, according to a recent Dun & Bradstreet report. Dun & Bradstreet’s recent Financial Services & Insurance Pulse Survey 2025…

Helios confirms Tucker CEO appointment, adds Parsons as INED

Helios Underwriting, the publicly listed firm providing direct access to a range of syndicates at the specialist Lloyd’s insurance and reinsurance marketplace, has confirmed the appointment of Louis Tucker as CEO, alongside the hire of Joanna Parsons as an Independent…

Commitment to long-term stability will ensure enduring success: QBE Re’s Killourhy

Executives at QBE Re noted that while they have seen some market softening, it remains manageable where rates are adequate, with some pricing pressures expected in property at 1.1, the casualty market to remain broadly stable, and a focus on…