Deductibles in ACA Marketplace Plans, 2014-2026

This analysis documents average deductibles for Affordable Care Act Marketplace plans available on Healthcare.gov in 2026 for all metal tiers, including silver plans after cost-sharing reductions are applied, as well as trend data since 2014.

How ACA Marketplace Costs Compare to Employer-Sponsored Health Insurance

This analysis compares ACA Marketplace costs to employer-sponsored health insurance costs and finds that individual market premiums have become more similar to employer-sponsored premiums since 2017. In 2024, individual market insurance premiums averaged $540 per member per month, slightly below…

Calculator: ACA Enhanced Premium Tax Credit

The ACA’s enhanced premium tax credits are set to expire at the end of 2025. This calculator estimates how much out-of-pocket premiums would increase for families if Congress does not extend the credits. The projected premium increases are estimated based…

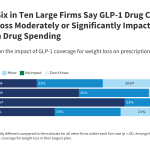

Perspectives from Employers on the Costs and Issues Associated with Covering GLP-1 Agonists for Weight Loss

While more large employers are covering GLP-1 drugs for weight loss, KFF’s conversations with employers highlight concerns about the cost of these medications. Many of these employers have considered scaling back coverage of GLP-1 agonists for weight loss, or in…

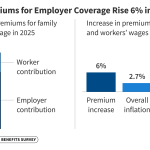

Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2025

Since 1999, the Employer Health Benefits Survey has documented trends in employer-sponsored health insurance. Every year, private and non-federal public employers with three or more employees complete the survey.

Explaining Individual Coverage Health Reimbursement Arrangements (ICHRAs)

This policy explainer describes what Individual Coverage Health Reimbursement Arrangements (ICHRAs) are and how do they differ from typical employer-sponsored health care plans.

2025 Employer Health Benefits Survey

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, worker contributions, cost-sharing provisions, offer rates, and more. This year’s report also looks at how employers are approaching coverage of GLP-1 drugs for…

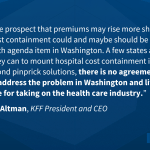

The Semi-Sad Prospects for Controlling Employer Health Care Costs

In a commentary on KFF’s 27th employer health benefits survey, President and CEO Dr. Drew Altman discusses the obstacles employers face trying to control their health care costs, and the reasons why they’ve never been meaningful supporters of government cost-containment…

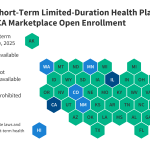

Examining Short-Term Limited-Duration Health Plans on the Eve of ACA Marketplace Open Enrollment

As Marketplace Open Enrollment nears, policy changes could leave millions of people facing substantially higher premiums and coverage loss, which could lead more consumers to purchase less expensive and less comprehensive coverage through short-term health plans. KFF analyzes short-term health…

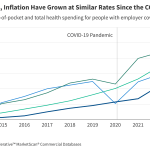

How Much do People with Employer Plans Spend Out-of-Pocket on Cost-Sharing?

This Peterson-KFF Health System Tracker chart collection examines trends in employee spending on deductibles, copayments, and coinsurance from 2012 to 2023 using a sample of health benefit claims for individuals under 65.