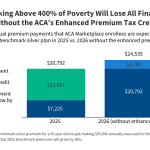

How Might Expiring Premium Tax Credits Impact People with HIV?

This issue brief provides an overview of the potential impact not extending enhanced ACA premium tax credits could have on people with HIV and the Ryan White HIV/AIDS Program. Enhanced credits have improved insurance coverage affordability for millions of people,…

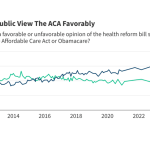

5 Charts About Public Opinion on the Affordable Care Act

A look at public opinion about the ACA and its provisions, including protections for people with pre-existing conditions and the impact of the law on families.

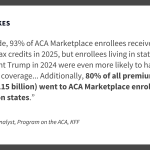

More Than 3 in 4 ACA Marketplace Enrollees Live in States Won by President Trump in 2024

As Democrats push for an extension of the ACA’s enhanced premium tax credits, new data from KFF show the extent to which states won by Trump in 2024 have come to rely on the ACA Marketplaces and the tax credits,…

The Regulation of Private Health Insurance

This Health Policy 101 chapter explores the complex landscape of private health insurance regulation in the United States, detailing the interplay between state and federal regulations that shape access, affordability, and the adequacy of private health coverage. It focuses on…

Employer-Sponsored Health Insurance 101

This Health Policy 101 chapter explores employer-sponsored health insurance (ESI), the primary health coverage source for non-elderly residents in the U.S. In addition to detailing ESI requirements and incentives, structure, availability, and costs, the chapter examines ongoing challenges related to…

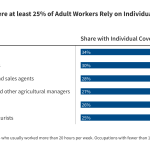

Occupations with Large Shares of Workers Who Rely on Individual Market Coverage

This analysis examines the share of adult workers in occupations that rely more heavily on individual market coverage for health insurance, which is largely made up by the Affordable Care Act (ACA) Marketplaces.

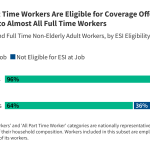

Part-Time Workers Have Less Access to Employer-Based Coverage Than Full-Time Workers

This brief examines key characteristics of part-time workers and their access to coverage. Part-time workers are much less likely than full time ones to be offered health benefits by their employer or to have health coverage at all.

Premium Payments if Enhanced Premium Tax Credits Expire

This data note examines how the expiration of the ACA’s enhanced premium tax credits could affect the out-of-pocket portion of premiums for different households.

How Much More Would People Pay in Premiums if the ACA’s Enhanced Premium Tax Credits Expire?

The ACA’s enhanced premium tax credits arre set to expire at the end of 2025. This calculator estimates how much out-of-pocket premiums would increase for families if Congress does not extend the credits. The projected premium increases are estimated based…

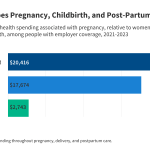

Health Costs Associated with Pregnancy, Childbirth, and Infant Care

This analysis examines the health costs associated with pregnancy, childbirth, post-partum care, and infancy. It finds that health costs associated with pregnancy, childbirth, and post-partum care average a total of $20,416, including $2,743 in out-of-pocket expenses, for women enrolled in…